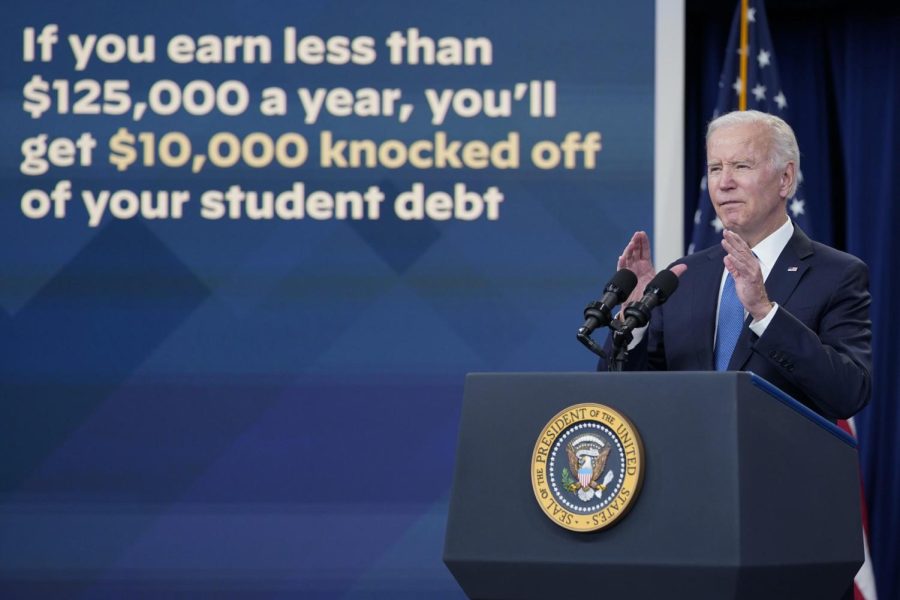

President Biden announces his student debt relief plan

Supreme Court’s student loan decision

Possible decisions and what might happen after

March 24, 2023

On Aug. 24, 2022, President Joe Biden announced a plan to cancel up to $10,000 in federal student loans for people earning under $125,000 or households earning less than $250,000 annually. In addition, Biden would also forgive $20,000 for students on Pell Grants. The Supreme Court has heard two cases, Biden v. Nebraska and Department of Education v. Brown, challenging the Biden administration’s legal authority to implement his plan.

In the case Department of Education v. Brown, plaintiffs Myra Brown and Alexander Taylor had student loans. Brown’s loans are commercially held, therefore, Brown is ineligible for debt forgiveness. Taylor is not eligible for the full $20,000 in debt forgiveness because he did not receive a Pell Grant. They challenged that Biden did not follow proper procedures; not notifying the public and not giving the public a chance to comment prior to implementing his plan.

Brown and Taylor have received backing from the Job Creators Network, a conservative economic advocacy group. Texas-based U.S. District Judge Mark Pittman ruled that Biden’s student loan forgiveness program was an unconstitutional use of legislative power that Congress had and therefore canceled the program. The United States Court of Appeals for the 5th Circuit left that ruling in place. Therefore, the Biden Administration appealed to the Supreme Court. The Supreme Court agreed to take on that case.

During the Supreme Court’s hearing, Supreme Court Justice Kentaji Brown Jackson questioned Nebraska’s solicitor general James Campbell as to why the Missouri Higher Education Loan Authority (MOHELA) was not undertaking the case. “It [MOHELA] has the ability to sue and be sued; it has been set up as a separate entity. Usually, we don’t allow one person to step into another’s shoes and say, ‘I think this person suffered harm’ even if that harm is very great.” Justice Amy Coney Barrett also inquired as to why MOHELA was not involved, “do you want to address why MOHELA’s not here?” Campbell claimed that “MOHELA isn’t here because the state is asserting its interests. MOHELA doesn’t need to be here because the state has the authority to speak for them.” Barrett then questioned, “if MOHELA is really an arm of the state…why didn’t you just strong-arm MOHELA and say, ‘You have to pursue this suit?”

On the other hand, Chief Justice John Roberts conveyed that Biden’s student loan forgiveness plan could be unfair to those who paid off their student loans or did not attend college. “Nobody’s telling the person who was trying to set up the lawn service business that he doesn’t have to pay his loan,” Roberts said, “he still does, even though his tax dollars are going to support the forgiveness of the loan for the college graduate, who’s now going to make a lot more than him over the course of his lifetime.”

Experts are uncertain about the action Biden could take to address student loan forgiveness if the Supreme Court blocks Biden’s current student loan forgiveness plan. Student loan expert Mark Kantrowitz believes that Biden could attempt to extend the pandemic-era pause on federal student loan payments if the Supreme Court rules against his student debt relief plan. However, Kantrowitz claims that Biden would be unlikely to extend the pandemic-era student loan payment pause program since Biden is set to end the COVID-19 national emergency in May.

Astra Taylor, co-founder of the debt collector union Debt Collective, stated that Biden could use a different law such as the Higher Education Act of 1965 to justify his debt relief program. This law states the Department of Education is able to “enforce, pay, compromise, waive, or release any right, title, claim, lien” involving student loans.

Some expert organizations have expressed potential concerns if the Supreme Court blocks Biden’s student loan forgiveness plan. U.S. Department of Education Undersecretary James Kvaal conveyed that if the Supreme Court rules against Biden’s student loan plan and Biden is not able to employ alternative legislation, federal student loan delinquencies and defaults could increase due to COVID-19.

National director of the youth and college division at the NAACP Wisdom Cole expressed concerns about the racial wealth gap increasing if action is not taken on student loan forgiveness. A Brookings Institution report revealed that Black student loan borrowers owe on average $7,400 more at graduation than white student loan borrowers. After graduation, Black student loan borrowers owe on average $24,720 more than white student loan borrowers.

Possible impacts of student loan forgiveness in the United States are yet to be determined.